On top of the historically high shipping charges, which will need to be paid, local governments will want to get their cut in the form of duties, taxes, and, unfortunately, tariffs. These costs differ depending on the destination.

Good News! Our team has put together a duties and taxes calculator to help provide an overview of the charges you will incur when shipping from China to Australia or the United States (pictured below). You can download it here for free!

Continue reading for a breakdown of these costs for Australia and the US.

The Basics

Terms to help you handle international shipping like a pro!

Customs Duties – based on product characteristics,

Tariffs – fees applied to bring foreign products into your country, and

Tax Rates (VAT/GST) – based on the total value of the product imported into the country.

Clients are generally in charge of these costs and are payable before delivery.

Australia

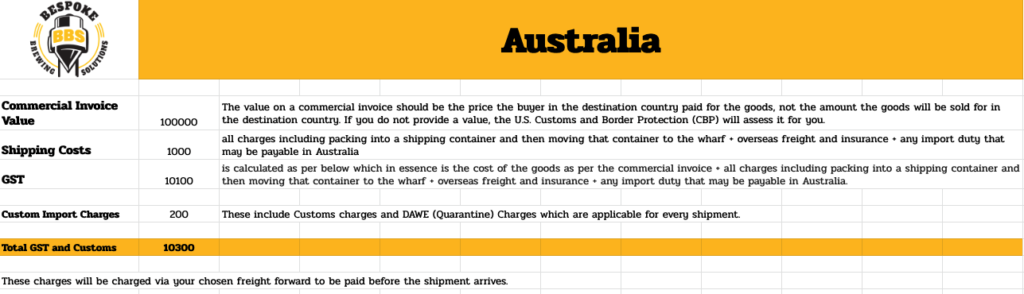

All shipments in Australia are subject to Import Duty, Customs Import Charges, and Goods and Service Tax (GST). This cost must be paid before your shipment is cleared by Customs. These charges will be charged via your chosen freight forwarder to be paid before the shipment arrives.

Below is a breakdown of the charges due to Customs when importing:

- Import Duty: This is a tax collected on imports and some exports by a country’s customs authorities. A good’s value will usually dictate the import duty. Depending on the context, import duty may also be known as a customs duty, tariff, import tax, or import tariff. Luckily Australia and China have the China–Australia Free Trade Agreement (ChAFTA). This means that by us providing you with a Certificate of Origin, the goods are duty-free.

- Custom Import Charges: In Australia, these charges include Customs charges and DAWE (Quarantine) Charges, which apply for every shipment.

GST: A value-added tax that is currently set at 10% of the commercial invoice value and shipping costs combined. This amount can be claimed back if your business is registered for GST. However, please note that GST reporting typically only occurs every 3 months.

a) Commercial Invoice Value: The total price of the product(s) included in the shipment as per the manufacturer’s invoice. It is important to note that this value is based on the destination country’s currency, not the currency of where it was sold.

b) Shipping Costs: The direct costs associated with moving your products from the factory to your door. This includes packing the products into the shipping container, moving that container to the wharf to be loaded, overseas freight, insurance for the shipment, and any import duty that may be payable.

United States

The US doesn’t have a national import tax as Australia does (GST). Instead, duties are calculated based on the specific type of item you are importing. All items are categorized into Harmonized Tariff Schedule (HTS) codes. Our most commonly used ones are listed below.

Other charges incurred at the US ports include an entry fee, Importer Security Filing (ISF) Fee, ISF Bond or U.S. Customs Bond, Handling Fee, Messenger Services, Additional Classifications, Merchandise Processing Fee (MPH), and Harbor Maintenance Fees (HMF). All fees are further explained below:

- Entry Fee: Used towards getting all required paperwork ready for the shipment’s entry into port.

- Importer Security Filing (ISF) Fee: a Customs and Border Protection (CBP) requirement for all ocean cargo imports to the United States for security purposes.

- ISF Bond: Only applicable if choosing to pay for the single entry bond instead of the continuous bond.

- U.S. Customs Bond: There are two options to pay this fee, as outlined below.

a) Single Entry Bond: $5.75 per $1,000 of the shipment value with a minimum of $55.00. There is also a placement fee of $41.00.

b) Continuous Bond: annual fee of $575.00. This amount covers a full year and is more economical because of the high-value shipments. Once your commercial invoice value reaches over $100K, this option becomes more economical. - Handling Fee: Covers the unloading of your containers off the vessel.

- Messenger Services: Covers the sending of documents via a courier service.

- Additional Classifications: After the first one, each additional classification is $3.00.

- Merchandise Processing Fee (MPH): 0.3464% of your shipment’s total value – not including duty, freight, and insurance charges. There is a minimum fee of $27.23 and a maximum fee of $528.33.

- Harbor Maintenance Fees (HMF): 0.125% of the commercial invoice value used by CBP to maintain all ports.

Duties and Tariffs: The amount charged will be based on the HTS code of your shipment.

a) Brewing Equipment – 8438.40.0000: 2.3% general duty rate. Also has Section 301 tariffs, List 4A, 7.5% effective as of 2/14/20.

b) Keg Washers – 8422.20.0000: free general duty rate. Also has Section 301 tariffs, List 1, 25% effective as of 7/6/18.

c) Kegs (≤30L) – 7310.29.00XX: free general duty rate. Also has Section 301 tariffs, List 3, 25% effective as of 5/10/19.

d) Kegs (>30L) – 7310.10.00XX: free general duty rate. Also has Section 301 tariffs, List 3, 25% effective as of 5/10/19.

NEED HELP CALCULATING DUTIES AND TAXES FOR YOUR BREWERY EQUIPMENT?

At Bespoke Brewing Solutions, we pride ourselves on helping our customers with every step of building their brewery, including identifying all costs to get their order delivered.

Whether you’re new to the international shipping world or well-seasoned, our shipping calculator is an easy way to get a general idea of potential duty and taxes fees!

Please note that this is only a guide and actual costs may vary depending on the freight forwarder, carrier, destination, etc. as they all will affect shipping costs and therefore duty and taxes.

If you have any questions at all regarding the shipping process, get in touch.

We would be happy to walk you through the process.

Disclaimer: The material and information contained in this blog is for general information purposes only. While we attempt to keep this information up to date and accurate, Bespoke Brewing Solutions makes no representation or warranty as to the accuracy, completeness, reliability, suitability, or availability with respect to the blog. Please work with your freight forwarder for an accurate breakdown of shipping costs.